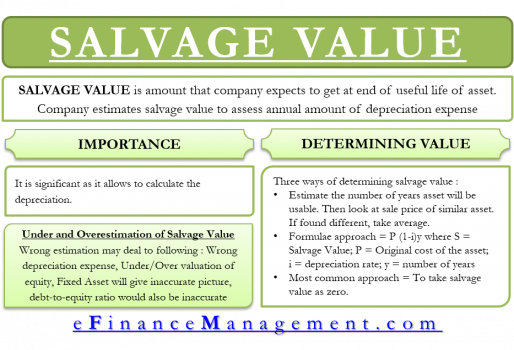

Depreciation is the process of allocating the value of a tangible asset over its helpful life, reflecting the asset’s consumption, wear and tear, or obsolescence. On the opposite hand, salvage value is the estimated worth of an asset at the end of its helpful life. Basically, the salvage value is the quantity a company expects to recuperate when the asset is no longer in use.

Finale Thought, Flip Property Into Advantage

In actual estate, land often retains its value, whereas buildings depreciate over time. Unlike equipment, real estate salvage worth depends heavily on location and market tendencies. Salvage value is the estimated quantity an asset is value on the end of its useful life. In different words, it’s the worth an organization can promote it for, both as a working asset or as scrap.

The asset must even have a determinable helpful life and be expected to final more than one yr. To qualify for depreciation, an asset must be owned by your business and used in a enterprise or income-producing activity. Salvage worth is the financial worth obtained for a set or long-term asset at the end of its useful life, minus depreciation.

What Is Salvage Worth, And Tips On How To Calculate After-tax Salvage Value?

- This calculation helps in evaluating the net good factor about disposing of an asset versus preserving it in operation.

- Corporations can promote these elements or scrap to get well some of the asset’s worth, thus decreasing the general value of possession.

- This conservative estimate accounts for the fact that business autos typically show more put on than personal vehicles with similar mileage.

It’s based on what the corporate thinks they can https://www.kelleysbookkeeping.com/ get if they promote that factor when it’s no longer helpful. Sometimes, salvage value is simply what the company believes it may possibly get by selling broken or old parts of one thing that’s not working anymore. Correct salvage worth estimation empowers decision-makers to allocate resources properly, comply with accounting requirements, and manage risk effectively.

Tips On How To Calculate After Tax Salvage Value: An Entire Information

This method assumes that the salvage value is a proportion of the asset’s original cost. To calculate the salvage value utilizing this technique, multiply the asset’s authentic price by the salvage value proportion. By incorporating these insights and examples, we can gain a deeper understanding of the significance of straight-line depreciation and salvage value in managing capital belongings. The balance sheet shows the web e-book value of an asset, which is the unique cost minus accumulated depreciation, helping stakeholders understand the asset’s current price. The estimated helpful life of the machine is 5 years, and its salvage worth is determined to be $2,000. Older belongings with shorter remaining useful lives generally have decrease salvage values.

This method assumes that the asset’s worth decreases at a relentless fee over time. By considering the after-tax salvage value, businesses could make strategic selections about whether or not to promote an asset or continue using it. This calculation helps in evaluating the web advantage of disposing of an asset versus maintaining it in operation. Remember, the aim isn’t to make an ideal prediction (that’s nearly impossible) however to make a solid estimate that helps you plan. After tax salvage value is like the retirement cash for a company’s equipment.

Some account for it, whereas others assume the asset will have no resale worth. Expertise belongings often have low salvage value, usually 5-10% of unique cost after five years. Use Part 179 expensing or 100% bonus depreciation for immediate tax advantages. This estimation means that the automotive will retain a worth of $5,000 on the how to find salvage value of an asset finish of its useful life.

Several challenges make it difficult to estimate an asset’s price at the finish of its life cycle. For tax purposes underneath MACRS, salvage value is zero, so revisions don’t apply. If an asset is used for each business and private, only the enterprise half is deductible. To estimate salvage value, the enterprise owner researches current market values for 2019 Ford Transit vans with about a hundred and fifty,000 miles.