QuickBooks Payroll costs more than some other suppliers within the trade. For example, Patriot’s costliest plan is $37 per 30 days, and its most cost-effective plan prices $17 per 30 days. If you have no price range to spend on payroll and solely need primary service, you could also pay your staff at no cost utilizing instruments like Payroll4Free. Terms, conditions https://www.quickbooks-payroll.org/, pricing, particular features, and service and support options topic to alter with out notice. Payroll software program can prevent time and money by automating tax submitting, direct deposit and worker self-service.

QuickBooks Payroll addresses widespread points corresponding to calculating payroll taxes, filing tax forms, and maintaining with new payroll necessities. Key features embody automated tax calculations, employee direct deposits, and real-time payroll reports. QuickBooks Payroll outshines many opponents concerning functionality and out there integrations. It additionally has further options to help guarantee you can provide competitive fee packages for your workers, corresponding to advantages and 401(k) administration tools. Nonetheless, the software is costly in comparability with other choices on the market.

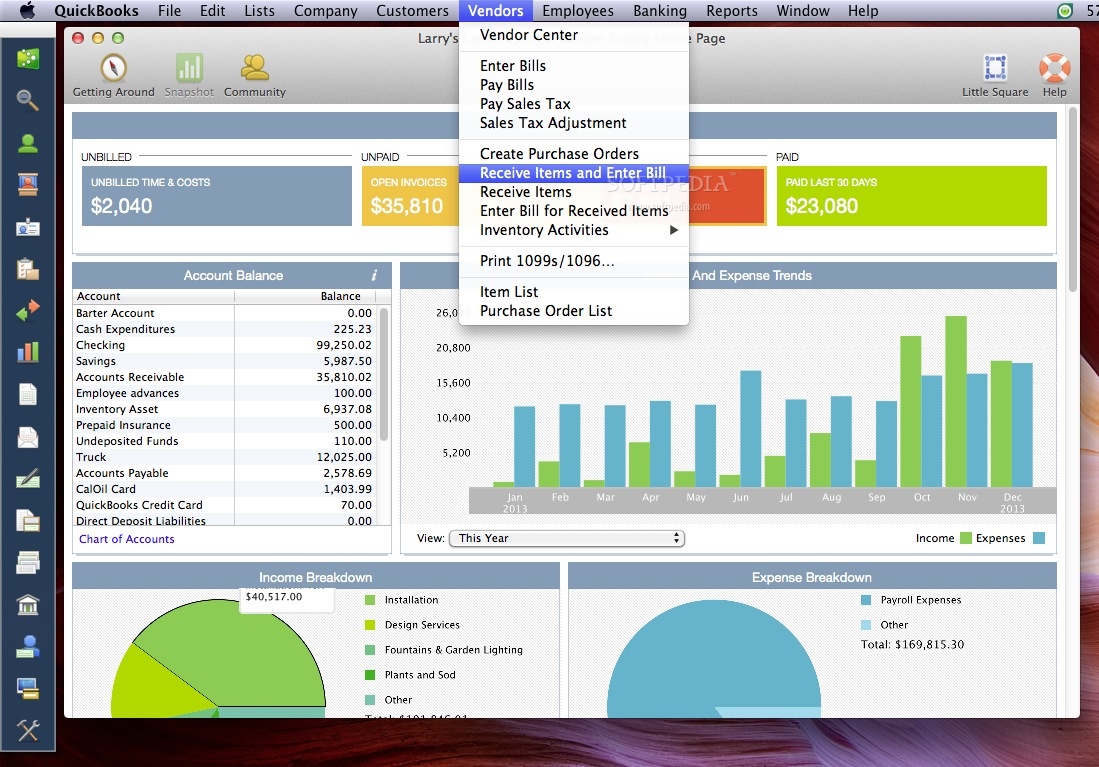

QuickBooks Payroll now includes staff management instruments so you can streamline your HR duties and save valuable time. From importing and sharing paperwork to requesting e-signature and automating l-9 compliance, do it all from one easy-to-use platform. Study how to get arrange, pay your team, find HRsupport and benefits, and sync with accounting soyou can handle every little thing in one place. QuickBooks Self-Employed is the only QuickBooks accounting product that doesn’t combine with QuickBooks Payroll. If you’re using QuickBooks Self-Employed and want to start paying employees with QuickBooks Payroll, you’ll must improve to a small-business QuickBooks Online plan first.

QuickBooks Payroll allows you to monitor time, run payroll accurately, fill and submit forms, file and pay taxes in time and more to remain compliant. In abstract, QuickBooks Payroll offers sophisticated but easy-to-use tax administration capabilities. This makes dealing with payroll taxes a lot less complicated for many companies.

How Troublesome Is It To Learn To Make Use Of Quickbooks Payroll Software?

Competitors like Gusto, Paychex, OnPay—honestly, most payroll software program solutions—all sync simply with QuickBooks Online. It is designed for payroll management and doesn’t meet the precise necessities for dealing with protected well being information beneath HIPAA rules. We additionally consider how easy it’s to integrate with other instruments typically found in the tech stack to increase the performance and utility of the software program. Instruments offering plentiful native integrations, third party connections, and API entry to build customized integrations score greatest. We put cash into deep analysis to assist our audience make better software program purchasing choices. We’ve examined more than 2,000 tools for various HR administration use circumstances and written over 1,000 comprehensive software evaluations.

And competitors like ADP, Paychex, and UZIO have higher payroll-plus-HR packages with extra complete HR options than QuickBooks. In addition to payroll processing, QuickBooks Payroll offers tools to manage employee benefits. It companions with SimplyInsured to offer workers medical, dental and imaginative and prescient coverage. Premium deductions get routinely calculated and added to the payroll. One Other companion, Guideline presents a 401(k) plan with automatic contributions or employer-set contributions quantities.

Free Payroll Setup Session

QuickBooks handles all the quickbooks payroll app payroll calculations behind the scenes. Accurately coming into all company payroll particulars ensures your taxes and regulatory varieties are crammed properly. You Will must outline your organization’s payroll insurance policies associated to pay cycles, pay dates, extra time rules, expense reimbursements, and extra. Your accountant may help set up compliant payroll guidelines aligned with labor legal guidelines and tax necessities. Handling payroll can be an incredibly advanced and time-consuming process for any enterprise. We’re a headhunter agency that connects US businesses with elite LATAM professionals who combine seamlessly as remote team members — aligned to US time zones, cutting overhead by 70%.

- But oversight remains to be wanted to validate figures and approve submissions.

- Any adjustments made on one platform automatically update across the others.

- Discover out everything you need to learn about 13th-month pay, including what it’s, tips on how to calculate it and where it applies.

- Premium deductions get routinely calculated and added to the payroll.

Our staff of consultants evaluates hundreds of enterprise merchandise and analyzes thousands of information factors that will assist you find the best product for your state of affairs. QuickBooks has a sturdy collection of assist articles, neighborhood discussions with different QuickBooks customers, video tutorials, webinars, and so on. on its Learn and Assist portal. Its collection of getting started videos guides you thru all initial steps from including an worker to updating tax info. If price isn’t a constraint for you, Intuit has a variety of products that integrate seamlessly with each other to construct an ecosystem to run your business.

Time Is Money—get More Of Each

Handling payroll could be a advanced process, but QuickBooks simplifies it with automation and easy-to-use instruments. By following the key steps coated in this guide, you’ll be able to seamlessly manage payroll end-to-end directly inside QuickBooks. With rigorous security enforced natively at each the software program and hardware ranges, you must use the QuickBooks Payroll app to handle payroll duties remotely with peace of mind.

Phrases and circumstances, options, support, pricing, and service choices topic to vary without notice. Explore our Payroll Sources Hub for more data on how to get started or guide a free arrange session with our expert onboarding team. The QuickBooks Payroll self-service portal allows workers to access pay stubs, set up direct deposit, update private info and more. This saves HR teams time on administrative duties whereas giving staff transparency and management. Solely licensed users can access payroll information through the app.

If you employ the notes part, which I do, you can’t truly see your notes till you create a pdf. We acquire intensive information to slender our greatest list to reputable, easy-to-use merchandise with stand-out options at a reasonable value level. And we have a look at consumer reviews to ensure that enterprise owners like you might be glad with our top picks’ services. We use the same rubric to assess firms inside a particular area so you’ll find a way to confidently follow our blueprint to one of the best payroll software. QuickBooks payroll software program has simple pricing for small companies. The Standard Payroll plan includes a monthly charge of $6.00 (including GST) per every ‚lively worker‘ paid by way of QuickBooks Payroll.